We’ve all been there: the “All-Hands” meeting where management unveils the company’s new “core values,” delivered with the enthusiasm of a soggy sandwich. Words like “synergy,” “innovation,” and “customer-centric” are paraded around as though they have deep meaning. Someone brings up “authenticity” while standing next to a chart showing declining profits. And of course, no cultural overhaul would be complete without a pizza party – because nothing says “we value you” like a lukewarm slice of bad pizza.

But here’s the thing: culture isn’t something you slap on the wall in the form of buzzwords. It’s not a checklist item or a one-off event with branded cupcakes. In small businesses and startups, founders get this instinctively. Culture is the business. It’s the unspoken energy, the late-night brainstorming sessions, the shared wins, and, sometimes, the mutual frustration. It’s personal. It’s raw. And it drives performance.

When Culture Meets Capital

Now, flip the coin. Enter the world of venture capital. The suits, the spreadsheets, the “growth at all costs” mentality. From the VC perspective, culture can look like a waste of money. After all, who pays for those bean bags and personalised lunchboxes? Do motivational posters generate revenue? Is “employee happiness” a line item that improves EBITDA?

It’s easy to see how culture gets viewed as fluffy nonsense when the focus is on multiples, margins, and quick returns. But here’s the uncomfortable truth: ignoring culture is a false economy. Yes, there’s an initial temptation to streamline operations, standardise processes, and get rid of the “unnecessary.” But morale? Engagement? Those intangibles have a way of turning into very tangible bottom-line results.

Think about it. Demoralised teams don’t innovate. Disconnected employees don’t push harder to hit targets. Staff turnover isn’t just disruptive – it’s expensive.

The ROI of the Basics: Empathy, Psychology, and Common Sense

Here’s where things get interesting. Culture continuity isn’t exactly a science. It’s more of an art form – a delicate balancing act of empathy, psychology, and common sense. But the returns are real.

Imagine acquiring a company and not immediately alienating the people who know how it runs. Imagine retaining key talent because they still believe in the mission. Imagine that morale doesn’t nosedive because employees aren’t being “re-onboarded” into a corporate identity they don’t recognise.

Empathy and understanding is what drives people, what makes them stay late without being asked, and what makes them proud of their work – translates into fewer resignations, smoother integrations, and higher productivity. And here’s the kicker: it’s often cheaper than the “corporate culture” replacements. No need for forced fun days or superficial perks when people feel genuinely connected to their work.

Cultural Continuity: The Unsung Hero of Profitability

Cultural continuity consulting isn’t about wrapping businesses in cotton wool. It’s about protecting the good stuff—the attitudes, values, and working styles that actually make a business profitable. Preserving these things post-acquisition means fewer disruptions, more support from the people who matter (the ones actually doing the work), and ultimately, a better return on investment.

Because when you think about it, what’s the bigger risk? Spending a little time and effort understanding and preserving a company’s unique cultural identity—or watching profits bleed away because no one bothered to consider how humans actually work?

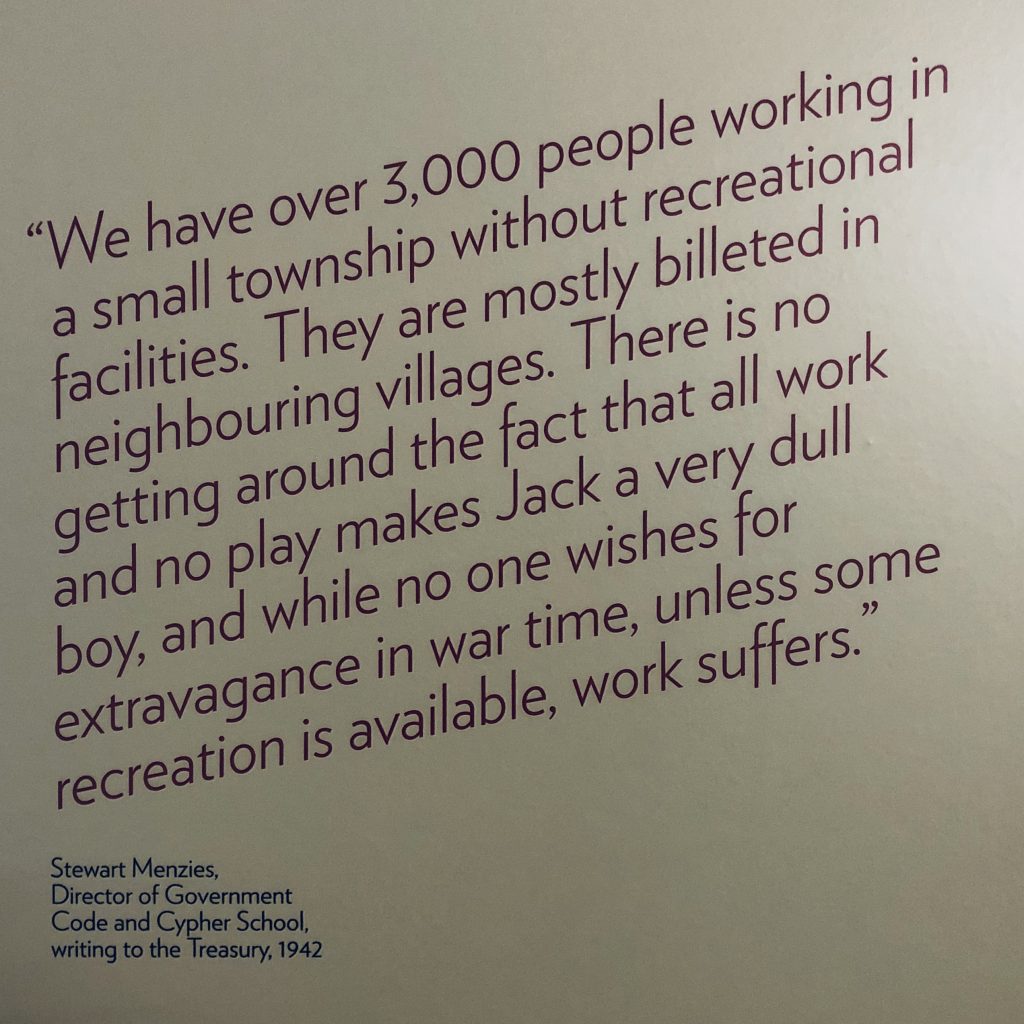

This isn’t anything new either; check out this snippet from 1942. A Director from Bletchley Park, the code-breaking unit, sent a letter to the treasury asking for some funds to keep morale high and keep staff in top condition.

Closing Thoughts: No More Pizza Parties

Let’s retire the idea that culture is just about feel-good moments and perks. It’s time to get serious about the fact that culture, when preserved and respected, is a strategic asset. The businesses that get this right don’t just see happy employees – they see real, measurable gains: lower turnover, higher morale, and stronger performance.

So, next time someone suggests that culture is a “soft” consideration in M&A deals, remind them that empathy, understanding, and continuity aren’t just moral imperatives—they’re profitable ones.